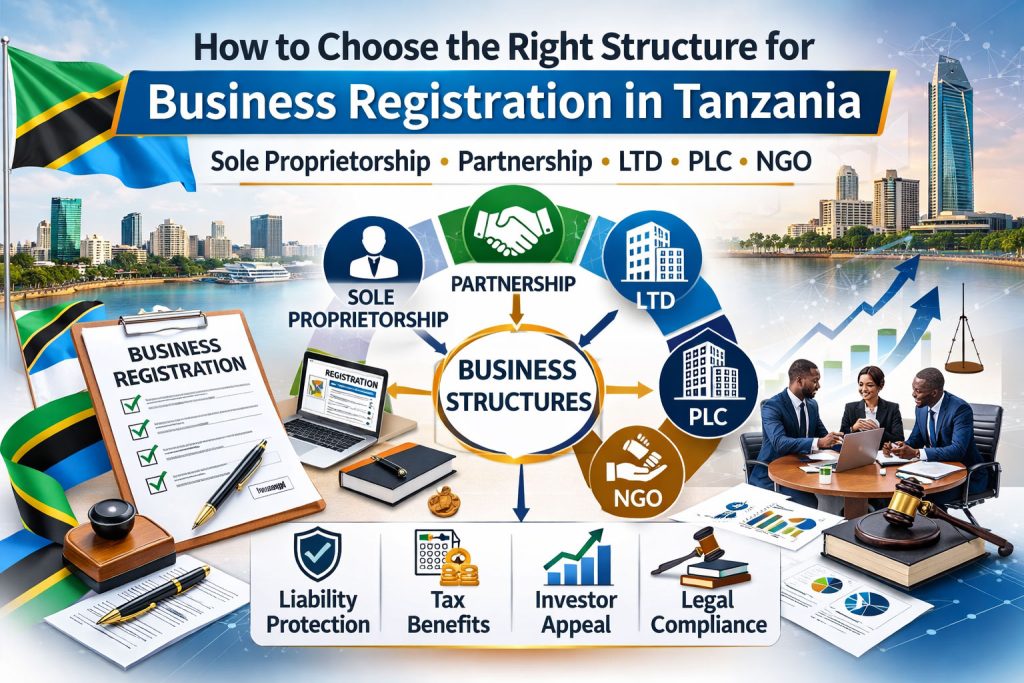

Starting a business in Tanzania is an exciting venture, but one of the most crucial decisions you’ll make is choosing the right business structure during the business registration in Tanzania process. The choice you make determines your legal obligations, tax responsibilities, liability exposure, and even your ability to attract investors. This article explores the main types of business structures in Tanzania and provides practical guidance for selecting the best option for your enterprise.

Why Choosing the Right Business Structure Matters

The structure you select during business registration in Tanzania affects several critical aspects of your business: legal liability, taxation, management and control, and funding opportunities. Selecting the wrong structure can lead to unnecessary tax burdens, legal complications, or even difficulties in expanding your business in the future. Understanding your options upfront ensures you make an informed decision that aligns with your business goals.

Main Business Structures in Tanzania

The Business Registration and Licensing Agency (BRELA) in Tanzania recognizes several types of business entities. The most common options for entrepreneurs include:

Sole Proprietorship

A sole proprietorship is the simplest form of business. It is owned and run by a single individual. This structure is common among small businesses, retail shops, and service providers in Tanzania.

Key Features: Owned by one person, owner has unlimited liability for business debts, profits are taxed as personal income, minimal regulatory requirements for registration. Pros include ease of setup during business registration in Tanzania, full control over decision-making, and simple tax reporting. Cons include unlimited personal liability, difficulty raising large-scale funding, and less credibility to investors. A typical example is a local Dar es Salaam café or a small tailoring shop registered as a sole proprietorship.

Partnership

A partnership involves two or more individuals running a business together. Partnerships are suitable for professional services like law firms, accounting practices, or family businesses.

Key Features: Owned by two or more individuals, partners share profits, losses, and management responsibilities, and liability can be unlimited depending on the type of partnership. Types of partnerships include general partnerships, where all partners share unlimited liability, and limited partnerships, where at least one partner has limited liability and does not participate in management. Pros include ease of establishment, shared decision-making and resources, and greater credibility than a sole proprietorship. Cons include potential conflicts among partners, personal liability for general partners, and possible disagreements over profit sharing. For example, two Tanzanian consultants starting a business together may opt for a partnership to combine expertise and capital.

Private Limited Company (LTD)

A Private Limited Company (LTD) is the most common structure for medium and large businesses in Tanzania. It is recognized as a separate legal entity from its owners, providing limited liability protection.

Key Features: Separate legal identity from its shareholders, minimum of one shareholder and maximum of 50, liability limited to the shareholder’s capital contribution, required to file annual returns and financial statements. Pros include limited liability protection, easier access to investors or loans, and higher credibility. Cons include higher setup costs, regulatory compliance requirements, and formalities in management and reporting. A tour operator in Arusha offering safaris across Serengeti, Ngorongoro, and Tarangire may register as an LTD to limit liability and attract foreign investors. For entrepreneurs seeking professional support, you can register a company in Tanzania with Max Ayo Consultancy for a smooth and compliant process.

Public Limited Company (PLC)

A Public Limited Company (PLC) is designed for large enterprises intending to raise capital from the public through the sale of shares.

Key Features: Separate legal entity, can offer shares to the public, must have at least seven shareholders, heavily regulated with stringent reporting requirements. Pros include access to large-scale capital, limited liability for shareholders, and high credibility. Cons include complexity and cost of establishment, extensive regulatory compliance, and mandatory public disclosure of financial information. Large Tanzanian companies in sectors like mining, banking, or telecommunications typically adopt the PLC structure.

Non-Governmental Organization (NGO) / Non-Profit Organization

For social enterprises and charitable initiatives, registering as an NGO or non-profit organization in Tanzania is an ideal option.

Key Features: Operates for social or charitable purposes, not profit, has a separate legal entity, and may be eligible for tax exemptions in some cases. Pros include limited liability for members, access to grants and donor funding, and positive public perception. Cons include inability to distribute profits to members, regulatory reporting requirements, and possible operational restrictions. NGOs promoting wildlife conservation in Serengeti or education initiatives in Dodoma may register under this structure. If you are a foreign investor, see our guide on registration of foreign company in Tanzania to understand the required steps.

Factors to Consider When Choosing a Business Structure in Tanzania

Choosing the right structure depends on several key factors. Liability and risk: consider how much personal liability you are willing to assume. Businesses in high-risk sectors such as construction or tourism may benefit from the limited liability protection of an LTD or PLC. Capital requirements: some structures, like PLCs, require significant capital investment. Small startups may find sole proprietorships or partnerships more practical. Tax implications: sole proprietorships and partnerships are taxed at the individual level, while LTDs and PLCs are subject to corporate tax. Management and control: if you prefer full control, a sole proprietorship may suit you. If you plan to share decision-making or bring in investors, consider partnerships or limited companies. Future growth: think long-term. If you plan to expand, attract investors, or secure bank financing, an LTD or PLC may provide more flexibility and credibility. Regulatory compliance: some structures require more stringent reporting, audits, and regulatory filings. Ensure you are ready to comply with BRELA requirements and other Tanzanian authorities. For a professional guide, consider registering a business in Tanzania to ensure compliance and faster approval.

Steps to Register Your Business Structure in Tanzania

Choose your business name and check availability with BRELA. Select your business structure using the guidance above. Prepare necessary documents such as identification, partnership agreements (if applicable), and the memorandum of association. Submit your application to BRELA, either online or offline. Obtain your certificate of registration, which could be a Certificate of Incorporation or Business Name Certificate. Register for taxes by obtaining a TIN from the Tanzania Revenue Authority (TRA) and register for VAT if applicable. Finally, obtain any necessary licenses depending on your business sector.

Conclusion

Choosing the right structure for business registration in Tanzania is a foundational step in building a successful enterprise. Your decision affects liability, taxes, management control, and growth potential. By understanding the key structures—sole proprietorship, partnership, LTD, PLC, or NGO—you can select an option that aligns with your business goals. Whether you are a local entrepreneur in Dar es Salaam, Arusha, or Zanzibar, or an international investor eyeing Tanzania’s tourism or trade sectors, selecting the correct business structure lays the groundwork for sustainable growth and credibility. For professional assistance, you can register a company in Tanzania or follow our guide on registration of foreign company in Tanzania to start your business with ease.

Add your first comment to this post